According to the report, SVOD revenues will reach $1.66bn by 2027, up from $476m in 2021.

African OTT movie and TV episode revenues will reach $2bn by 2027, triple from $623m in 2021, according to the Africa OTT TV and Video Forecasts report from Digital TV Research.

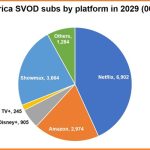

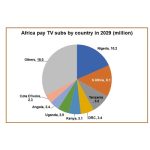

South Africa and Nigeria will together account for 56% of the total by 2027, leaving $896m divided between the other 33 countries. SVOD revenues will reach $1.66bn by 2027, up from $476m in 2021, driven by a predicted 13.72m SVOD subscriptions by 2027, up from 4.89m at the end of 2021.

Netflix will account for 6.411m subscribers by 2027, 47% of the region’s total SVOD customers. Amazon Prime Video is forecast to have 2.18m paying subscribers by 2027, up from barely over half a million in 2021 while Disney+ is set to grow from a standing start in 2021 to 1.341m customers by 2027. However, the service is set to have only a limited rollout in South Africa (2022) and Nigeria (2023).

Commenting on the findings of the report, Simon Murray, Principal Analyst at Digital TV Research, said: “Disney+ will only have a limited roll-out: South Africa (2022) and Nigeria (2023). We do not think that Paramount+, HBO Max or Peacock will start as standalone platforms in Africa. HBO will continue its distribution deal with Showmax. Francophone MyCanal started as a free add-on for Canal Plus pay-TV subscribers in 2021. In our last forecasts, we expected MyCanal to be a standalone platform. We now do not believe that this will happen. This will stifle SVOD growth in the Francophone countries.”