Disney+ will reach 121m subscribers by 2026, double its 2021 total.

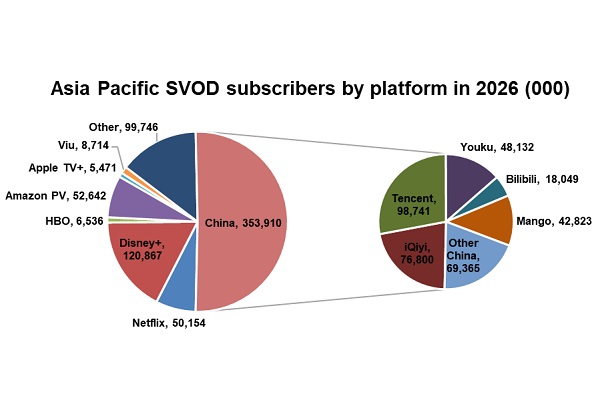

APAC will have 698m SVOD subscriptions by 2026, up from 502m at the end of this year, according to the latest report from Digital TV Research.

China will provide 354m SVOD subscriptions in 2026, or half of the region’s total, with India reaching 157m. However, China’s growth is set to slow, due to new online anti-fan regulations that limit game time for minors and force SVOD platforms to screen fewer reality shows.

The study showed that Disney+ overtook Netflix in subscriber terms in 2020, almost entirely due to its success in India. Disney+ will reach 121m subscribers by 2026, double its 2021 total.

Of the near 354m Chinese SVOD subscribers expected by 2026, Tencent is predicted to be the market leader with 98.7411m subscribers followed by iQIYI on 76.8m; Youku, 48.132m; Mango, 42.823m; and Bilibili, 18.049m.

Across the region, The Asia Pacific SVOD Forecasts report noted that by 2026 Amazon Prime Video will likely have 52.642m subscribers, edging out Netflix which will have 50.154m. These players will enjoy a massive leadership gap on the next SVOD companies such as Viu on 8.714m and Apple TV+ with 5.471m.

Commenting on the findings of the report, Simon Murray, Principal Analyst at Digital TV Research, said: “China will remain dominant, although its growth will slow. This is due to new online anti-fan regulations that limit game time for minors and force SVOD platforms to screen fewer reality shows. This will dampen interest in SVOD.”