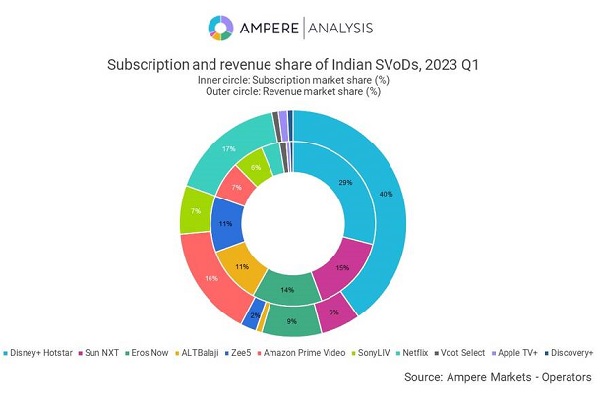

With a market share of 29% of India’s 171m subscribers, the SVOD player shifts to focus on profitability and ARPU.

Indian streaming service Disney+ Hotstar still leads with a 29% market share despite recent declines in subscribers, according to a study by Ampere Analysis.

Disney+ Hotstar has changed its strategic focus in response to rising costs, in particular sports rights costs. Rather than pursuing new subscribers at any price, the player is pivoting towards a focus on profitability and increasing ARPU (Average Revenue per Subscriber).

As of Q1 2023, Disney+ Hotstar had about 50m subscriptions, outstripping other global SVODs in India including Amazon Prime Video (12.4m) and Netflix (6.2m). Ampere expects it to remain the market leader despite some of the recent market changes.

According to Ampere, cost management around sports rights is a priority for the business, as illustrated by the company’s withdrawal from the IPL rights auction earlier in 2022. Ampere estimated that this saved the company a figure just short of twice its entire streaming revenue from the past five years.

Disney+ Hotstar is being more careful in its spending, especially on acquiring titles, according to the report. It ended its licensing deal with Warner Bros. Discovery in March 2023 and did not bid for rights to distribute Paramount and NBCU titles in India. All three Hollywood studios’ content are instead sitting on Jio Cinema, which is also the home streamer for the IPL.

Ampere believes that to support ARPU growth, Disney+ Hotstar must also review its partnership deals with mobile telcos and encourage direct subscriptions. Currently, it has distribution deals with all the top three mobile telcos in India. Certain mobile or broadband customers with Reliance Jio, Bharti Airtel, and Vodafone have free access to Disney+ Hotstar. While such bundling deals increase service adoption and support reach for ad sales, they impact subscription ARPU. Disney+ Hotstar’s ARPU was just at $0.59 in 2023Q1, over 10 times lower than the $6.47 of the core Disney+ service.

Commenting on the findings of the report, Orina Zhao, Senior Analyst at Ampere Analysis, said: “With India set to keep its position as the world’s third largest SVOD market after the US and China with an expected growth to 180m subscriptions in 2027, it is important for Disney+ Hotstar to balance its content expenditure and subscription retention and acquisition. Jio Cinema is expected to announce more standard subscription plans later this year which will increase direct competition with existing players and change the ecosystem of the market. Disney+ Hotstar still owns 123 of the top 500 most popular titles in India, by Ampere’s estimates, which places it behind Amazon Prime but ahead of Netflix (117 titles) and far ahead of Jio Cinema (38 titles), but now needs to find new sustainable strategies to improve profitability while maintaining its significant subscriber base in India.”