According to the report, global E&M revenue will grow at a compound annual growth rate (CAGR) of 5.0%, taking industry revenues to US$2.6tn in 2025.

The $2+tn global entertainment & media (E&M) industry is on track to grow 6.5% in 2021 and 6.7% in 2022, fueled by strong demand for digital content and advertising. The renewed growth follows a challenging 2020, when in-person entertainment plummeted, including a 71% decline in movie theatre box office revenues, according to a report titled Global Entertainment & Media Outlook 2021-2025 by PwC.

The 22nd annual analysis and forecast of spending by consumers and advertisers across 53 territories – categorically states that the E&M industry has regained its momentum, with revenues outpacing the economy as a whole.

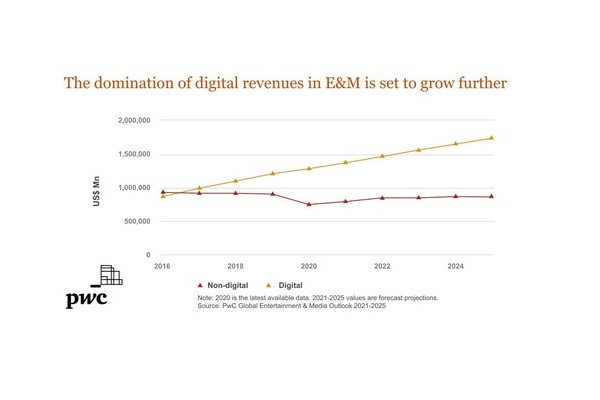

The extent of the rebound was shown in the report which noted that the 3.8% decline in global E&M revenue, from US$2.1tn in 2019 to US$2.0tn in 2020, the biggest year-on-year drop in the Outlook’s 22 years. PwC predicts that from 2021 to 2025, global E&M revenue will grow at a compound annual growth rate (CAGR) of 5.0%, taking industry revenues to US$2.6tn in 2025.

Going forward a number of E&M segments showed the shifting consumer demand. Traditional TV/home video remains the largest E&M consumer segment generating US$219.0bn but this is forecast to but will continue to shrink by 1.2% CAGR over the next five years. Not surprisingly, many younger consumers were found to have little awareness of, or interest in, traditional media. On the other hand, media platforms designed for young consumers or that enable lightly-produced, authentic content have boomed.

By contrast, video streaming boomed in 2020 and its growth trajectory is projected to continue with the subscription video-on-demand (SVOD) sector set to grow at a CAGR of 10.6% to 2025, making it an US$81.3bn industry. Meanwhile, cinema revenues are projected to rebound in 2021 as lockdowns ease but will not recover to pre-pandemic levels until at least 2024.

Video game and esports revenues continue their rapid ascent, reaching US$147.7bn in 2020, with a 5.7% CAGR projected to expand the segment to become an almost US$200bn business (US$194.4bn) by 2025.

Virtual reality (VR) is the fastest-growing E&M segment, albeit from a small base. Its revenues surged by 31.7% in 2020 to US$1.8bn and are projected to sustain a CAGR of 30%+ over the next five years to reach US$6.9bn business in 2025.

Music is poised for robust growth following a massive 74.4% slump in live music revenues in 2020. It is expected that the total music revenues to grow at a 12.8% CAGR over the next five years, fueled by digital streaming, which will expand to become a US$29.3 bn business by 2025, along with a return to live performances.

Spending on internet advertising rose by 9% to US$336bn in 2020, overtaking non-internet ad spending for the first time, and is projected for strong growth of 7.7% CAGR over the next five years.

Mobile internet access revenues rose at a 6.1% CAGR from US$449bn in 2020 to US$605bn in 2025, underpinned by the spread of 5G, advances in handset technology, and premium content bundles. Internet access accounted for 34% of E&M spending in 2020 and will increase at a 4.9% CAGR, from 2020’s US$694bn to US$880bn in 2025.

On the other hand, media platforms designed for young consumers or that enable lightly-produced, authentic content have boomed. Gaming is central to the youth movement and is becoming a significant driver of data consumption – in fact, it is on pace to be the fastest-growing content category in that regard, accounting for 6.1% of total data consumption globally by 2025, up from 4.7% in 2020.

Commenting on the findings of the report, Werner Ballhaus, Global Entertainment & Media Industry Leader Partner, PwC Germany, said: “The pandemic slowed the entertainment and media industry last year, but it also accelerated and amplified power shifts that were already transforming the industry. Whether it’s box office revenues shifting to streaming platforms, content moving to mobile devices, or the increasingly complex relationships among content creators, producers and distributors, the dynamics and power within the industry continue to shift. Our Outlook shows that the hunger for content, continued advances in technology and new business models and ways of creating value will drive the industry’s growth for the next five years and beyond.”

CJ Bangah, Technology, Media & Telecom Principal, PwC in the US, added: “2020 was unprecedented, and we expect the kind of growth and contraction within and across E&M segments we have experienced to continue. The power of digital, including the early stages of 5G use cases and the exponential growth of streaming, together with consumers embrace of new and enhanced experiences are a constant force for change. Dynamic shifts within the E&M ecosystem are likely to expand as the industry responds to the evolving landscape of future consumption patterns.”