After growing by 35.4% in 2020, OTT video surged another 22.8% in 2021, pushing revenues to $79.1bn.

Following a pandemic-related 2.3% decline in 2020, global entertainment & media (E&M) revenue rose a strong 10.4% in 2021, from $2.12tn to $2.34tn, according to the findings from PwC’s Global Entertainment & Media Outlook 2022-2026, the 23rd annual analysis and forecast of E&M spending by consumers and advertisers across 52 countries and territories.

Global video games and esports revenue totalled $215.6bn in 2021 and is forecast to grow at a 8.5% CAGR to $323.5bn in 2026. Asia Pacific generated the lion’s share of revenues in 2021 with $109.4bn, almost double North America, the second-highest region. Gaming is now the third-largest data-consuming E&M content category, behind video and communications.

VR continues to be the fastest-growing E&M segment, albeit from a relatively small base. Global VR spend rose by 36% y-o-y in 2021 to $2.6bn, following on the hot 39% growth in 2020. Growth between 2021 and 2026 is expected at 24% CAGR, bringing the segment to $7.6bn. Gaming content is the primary contributor to VR revenue, taking in $1.9bn in 2021. This should increase to $6.5bn in 2026, 85% of total VR revenue.

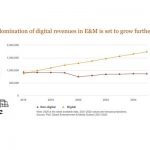

Advertising’s spread throughout the digital world has made it a dominant industry category. After a decline of nearly 7% in 2020, advertising grew an impressive 22.6% in 2021 to $747.2bn. Driven almost entirely by digital, advertising is set to grow at a 6.6% CAGR through 2026. In 2026, advertising is projected to be a $1tn market and the largest E&M revenue stream, having surpassed consumer spending and internet access.

After growing by 35.4% in 2020, Over-the-top (OTT) video surged another 22.8% in 2021, pushing revenues to $79.1bn. The pace of OTT revenue growth will moderate somewhat; it is expected to grow at a 7.6% CAGR through 2026, pushing revenues to $114.1bn.

Traditional TV, beset by competition from OTT streaming services, still generates considerable revenues, but its inexorable decline will continue, with global revenues projected to shrink at a -0.8% CAGR from $231bn in 2021 to $222.1bn in 2026.

Global cinema revenue is bouncing back, reversing its pandemic-driven losses, and is expected to reach a new high of $46.4bn in 2023. Box office revenue is projected to reach $49.4bn in 2026 from $20.8bn in 2021, an 18.9% CAGR. China surpassed the US to become the world’s biggest cinema market in 2020, and is expected to retain this leadership through 2026.

Live music revenue is projected to exceed pre-pandemic levels in 2024. Digital music- streaming subscriptions are driving growth in the recorded music sector where revenues are forecast to rise from $36.1bn in 2021 to $45.8bn in 2026

Commenting on the finding of the report, Werner Ballhaus, Global Entertainment & Media Industry Leader, PwC Germany, said: “Industry press tends to focus on the companies that have dominated the E&M industry. But it is the choices that billions of consumers make about where they will invest their time, attention and money that are fueling the industry’s transformation and driving the trends. We are seeing the emergence of a global E&M consumer base in the coming years that is younger, more digital and more into streaming and gaming than the current consumer population. This is shaping the future of the industry.”

At a regional level, North America commands by far the highest E&M spend per capita, at $2,229, nearly double Western Europe’s $1,158. By contrast, the Asia Pacific, which was the largest E&M region by revenue in 2021 at $844.7bn, has per capita spend of $224. The Middle East and Africa have the lowest per capita E&M spend of any region globally, at $82.

The top ten growth markets by CAGR, meanwhile, are focused in Latin America, the Middle East, Africa and Asia, with OTT video and gaming providing the majority of revenue growth, and esports and cinema seeing fast growth as well. Turkey (estimated 14.2% CAGR), Argentina (10.4%), Indi

CJ Bangah, Technology, Media and Telecommunications Principal, PwC United States, added: “Coming out of the pandemic, we’ve seen a strong recovery across key sectors. This has set a new growth platform for Entertainment and Media heading into a turbulent future with fault lines, fractures, and new monetisation opportunities dotting the landscape. As we enter FY23 and beyond, expect to see continued growth in digital-only and digital-enabled content and media experiences, gaming becoming the new battleground for consumer entertainment, and content and streaming being transformed by market and consumer dynamics.”