Advertising revenues projected to top $1tn in 2026, with revenues in 2028 to represent double the revenues of 2020.

Despite economic challenges, technological changes, and increased competition, the global entertainment & media (E&M) industry experienced a 5% revenue growth in 2023, reaching $2.8tn, surpassing the overall economic growth rate reported by the IMF, according to PwC’s Global Entertainment & Media Outlook 2024-28.

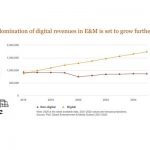

The report, covering 11 revenue segments across 53 countries, projects global E&M revenues to reach $3.4tn by 2028, growing at a 3.9% compound annual growth rate (CAGR). Advertising revenue is anticipated to hit $1tn by 2026, accounting for more than half (55%) of total E&M industry growth over the next five years.

Streaming services, traditionally reliant on subscriptions, are facing increased competition and challenges in consumer engagement. To drive growth, they are focusing on live sports, cracking down on password sharing, and adopting ad-based models.

The US remains the largest market for consumer spending and advertising, with a 4.3% CAGR to 2028, representing over one-third of global spending in 2023. However, markets like China (7.1%), India (8.3%), Indonesia (8.5%) and Nigeria (10.1%) are growing faster.

Werner Ballhaus, Global Entertainment & Media Leader, PwC Germany, said: “As the global entertainment & media industry continues to grow, market players face both risks and opportunities. Shifts in consumer preferences, and uncertainty around the continued impact of digital transformation and new and emerging technology such as Generative AI, are inspiring a wave of business model reinvention. If market players are to gain their share of the growing revenue pools we identify, they will have to reimagine how their company creates, delivers, and captures value, leveraging the growth of advertising while also harnessing the powerful opportunity presented by AI. As consumers increasingly consume content online, companies will also need to diversify their product-offerings and continue to connect with consumers on the platforms where they spend more of their time.”

Global advertising revenue is expected to grow at a 6.7% CAGR through 2028, outpacing connectivity (2.9%) and consumer segments (2.2%). All the while, total advertising revenue is to hit $1tn in 2026 (while 2028 revenues will hit double the revenues of 2020). Advertising is projected to account for 55% of the total E&M industry’s growth over the coming five years based on the three broad E&M segments analysed.

Internet advertising, the largest and fastest-growing component, increased by 10.1% in 2023, adding $52.5bn in new revenues, and is projected to grow at a 9.5% CAGR through 2028, accounting for 77.1% of total ad spending.

Streaming service subscriptions are rising, but at a slower rate, with global subscriptions to OTT video services expected to reach 2.1bn by 2028 from 1.6bn in 2023. Average revenue per subscription is projected to grow modestly, from $65.21 in 2023 to $67.66 in 2028. This has led streaming platforms to explore ad-based models, password-sharing crackdowns, live sports, and industry consolidation to generate new revenue streams.

Global gaming, including e-sports, continues to be one of the fastest-growing sectors, with revenues reaching $227.6bn in 2023, up 4.6%. Revenue is projected to exceed $300bn by 2027, almost doubling its 2019 level. The Asia-Pacific region remains the largest market, expected to account for 54.4% of global gaming revenue by 2028.

In-person, tech-enabled experiences such as live music and cinema are key growth areas, with movie box office and music ticket sales comprising 38.6% of 2023’s consumer spending increase. Live music revenues rose 26%, driven by major events like world tours, while cinema spending saw a 30.4% increase, with global revenues expected to surpass pre-pandemic levels by 2026.

Wilson Chow, Global Technology, Media and Telecommunications (TMT) Industry Leader, PwC China, concluded: “The global entertainment & media industry has always thrived on technological disruption. To capitalize on the many growth opportunities, it must leverage the power of new and emerging technologies such as Generative AI, reshape business and creative models, and leverage the technology for advertising. So far, many of the applications of Gen AI in the E&M industry have focused on speed and efficiency. As we look ahead, the industry will have to focus on how Gen AI can lead to greater value creation through experimenting, iterating, and scaling new solutions and processes.”