Online video subscriptions in MENA exceeded 1m in 2017 for the first time, up 48% over the previous year.

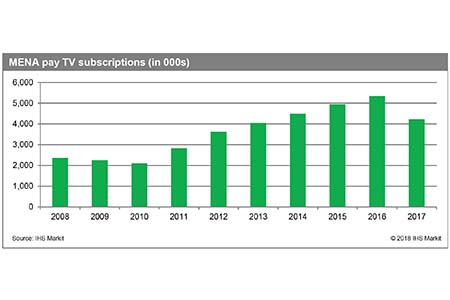

Political events have reportedly reversed pay-TV growth in the Middle East and North Africa (MENA), as pay TV subscriptions fell 21% to 4.2m in 2017, according to the latest study by IHS Markit.

Political events have reportedly reversed pay-TV growth in the Middle East and North Africa (MENA), as pay TV subscriptions fell 21% to 4.2m in 2017, according to the latest study by IHS Markit.

The research firm said that the growth reversal was linked to blocks on beIN Media and also stated that a prolonged block could seriously affect the future growth prospects of pay TV in the region.

Online video subscriptions in MENA exceeded 1m in 2017 for the first time, up 48% over the previous year. Subscriptions are forecast to grow at a compound annual growth rate (CAGR) of 34.4%, over six years, reaching 5m in 2022.

Online video revenue grew 44%, year on year, exceeding $100m for the first time.

The over-the-top (OTT) market in the MENA region also grew, with online video subscriptions reaching 1.4 million at the end of 2017. However, according to the study, subscription video on demand (SVoD) appears to be a complement to pay TV, rather than a direct competitor.

Even as pay-TV subscriptions declined, there were other positive developments for entertainment markets in the MENA region. Principal among them was a reform of the media ecosystem in Saudi Arabia, which included the reopening of cinema theaters in the country, and a planned $64 billion investment of state and private funds in the countrys entertainment sector over the next 10 years.

The OTT subscription video market in MENA grew 48% in 2017, compared to the previous year. OTT subscriptions reached 1.38M, which is the first time the market exceeded 1m subscriptions. Also for the first time, revenue exceeded $100m, growing 44% over the same period. Revenue is expected to reach $500m in 2022, growing at a CAGR of 36.6%. In 2017, the number of OTT subscriptions were one-third of the number of pay TV subscriptions. This share will increase to 50% in 2020 and 67% in 2022.

The pattern of growth will be determined by the decisions of the main players primarily by their strategies for content, localisation, partnerships and pricing. Starz Play was the online subscription services market leader, in both subscriptions and revenue, followed by local service Shahid Plus and Netflix. Starz Plays success, the report stated, was based on a smartly implemented policy of partnering with local telcos and IPTV networks, to offer payment solutions accessible to the vast majority of people in the region.

Pay-TV subscriptions declined in the Middle East and North Africa (MENA) region in 2017 while online video subscriptions grew 48% year-on-year, according to IHS Markit.

Also read: Starz Play tops Netflix in MENA market share: IHS study