According to the research, Netflix will hit 30% European content with the addition of just 408 European titles (or the removal of 953 non-European) in the UK also.

Netflix’s European content has grown rapidly over the past few months and now stands at or above 30% of programming in nearly all of its major European markets, according to research by Ampere Analysis.

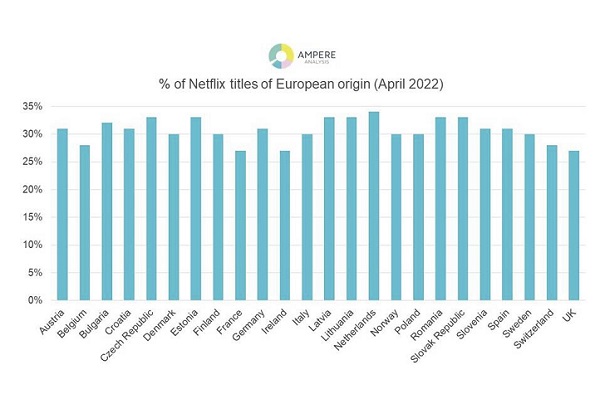

As of April, the streamer has hit the 30% quota in Austria, Bulgaria, Croatia, the Czech Republic, Denmark, Estonia, Finland, Germany, Italy, Latvia, Lithuania, the Netherlands, Norway, Poland, Romania, the Slovak Republic, Slovenia, Spain and Sweden.

Netflix is still falling short in the UK and Ireland, where series like The Crown accounts for 27% of content classed as European, with France, Belgium and Switzerland also slightly under.

According to the study, 16 of the 27 markets analysed had less than 30% European content last December, showing a quick improvement in the few months since. In the UK, Netflix will hit the 30% target by adding 408 European titles, or by removing 953 non-European projects.

Netflix is ahead of its global streaming rivals concerning European content, but those rivals are ramping up their contribution too, with Amazon’s Prime Video exceeding the 30% quota in Germany, Switzerland and Italy, while being on par with Netflix in the UK. Other Prime Video markets range from 16% to 28%.

HBO Max also has a large proportion of European projects in its local catalogues, with the majority of its European footprint already exceeding 25%. Disney+ still has some way to go, hovering around the 10% mark for its European content, although it is increasing its European original production activities.

Commenting on the findings of the report, Guy Bisson, research director at Ampere Analysis, said: ‘’Quietly, while no-one was watching, Netflix has boosted the proportion of its catalogue titles that are European to the point where meeting new quota regulations should have no negative impact on its regional business. The milestone is a reflection of heavy investment in content outside the US which is rapidly being mirrored by other global streaming players. Perhaps more surprising than Netflix’s 30% milestone is the fact that some of the newer major studio players are already rapidly approaching a similar proportion of European content in their local catalogues.”