The Aero Satcom market, one the major opportunity verticals for satellite operators and providers, has been hugely impacted by the Covid situation. This may compel faster consolidation.

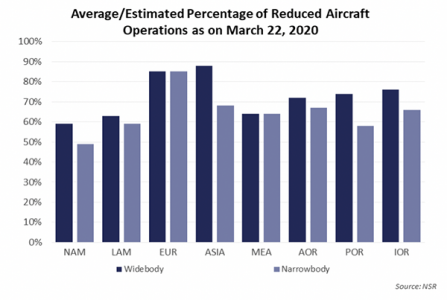

The aeronautical satcom industry is estimated to lose $1.8bn in retail IFC revenues (Service + Equipment) from 2020-2022 owing to reduced operations and revised load factors, according to NSRs Aeronautical Satcom Markets, eighth edition. In March 2020, the overall Narrowbody Commercial Aircraft operations reduced by 49% to 85%, and wide-body commercial aircraft operations reduced by 59% to 88% across different regions. The trend followed with multiple aviation market exits and OEMs reducing their production rates. The impact is certain to flow to upstream players resulting in a capacity revenue opportunity loss of $1.1bn from 2020-2022.

The aeronautical satcom industry is estimated to lose $1.8bn in retail IFC revenues (Service + Equipment) from 2020-2022 owing to reduced operations and revised load factors, according to NSRs Aeronautical Satcom Markets, eighth edition. In March 2020, the overall Narrowbody Commercial Aircraft operations reduced by 49% to 85%, and wide-body commercial aircraft operations reduced by 59% to 88% across different regions. The trend followed with multiple aviation market exits and OEMs reducing their production rates. The impact is certain to flow to upstream players resulting in a capacity revenue opportunity loss of $1.1bn from 2020-2022.

Distressed downstream players are also treading water to survive. IFC is clearly a highly competitive market, particularly at the service provider level where most of the focus is on specialised aero solutions. While satellite operators such as SES and ViaSat are witnessing resilient toplines owing to diversified target markets where Aero Satcom contributes <10% of total revenues per Q1 2020 earnings, service providers are facing major and immediate challenges. For instance, GoGo witnessed >20% drop in ARPA in Q1 2020.

Looking at the value chain, the AERO Satcom market is moving towards consolidation, according to NSR analyst Vivek Suresh Prasad.

In the pre-Covid scenario, Aero Satcom was on track to transition from Stage Scale to Stage Focus with the top three service providers (GoGo, Panasonic & Iridium) cumulating 67.7% of total market share. The other major drivers pushing the market to the next stage were the free service model, capacity/service price drops and improvement in per Aircraft Bandwidth or Data usage. The result was that regions such as the North American corridor were beginning to experience a supply crunch, and Deltas free model was regarded as the shape of things to come for most, if not all, airlines in all regions of the globe.

However, Covid changed everything and instead of following Path A to B to C, the Aero Satcom Market has moved to Point AB because of the sudden market shrinkage. Point AB is in equivalence with A and hence makes the Aero Satcom vertical more favourable for consolidation.

Prasad reckons there are two possible consolidation scenarios as most companies in their strategy development phase respond to the ongoing crisis:

One is a downstream horizontal merger or acquisition.

This will result in reduced competition and optimised solution for aviation customers, which now buy from multiple players across regions and airframes. However, the seamless merger will depend on the identification of efficient network/product/services and removing overlaps. On the upstream side, this will result in reduced capacity leases/contracts for satellite operators because of the reduction in their number of customers (service providers), says Prasad.

The second is vertical integration.

Here, we are looking at a satellite operator acquiring a service provider or service provider + equipment supplier. Satellite operators have been gazing and facing challenges to move downward in the value chain. The current scenario could be considered as an opportunity to knock at their door. This scenario coupled with an optimised solution (capacity + service interface + hardware) can lead to more affordable solutions for end customers as margins will not get added to the cost at different levels. Also, a satellite operator with global coverage can lead to an efficient scalable solution, explains Prasad.

The bottom line is that market consolidation must become a top priority, especially for IFC stakeholders, says Prasad.

At present, the aero satcom market is going through major challenges with the most pressing being distressed downstream players in survival mode, and user market shrinkage likely to continue over the next 18 to 24 months. Over the horizon, however, long-term fundamentals of the segment remain strong. Hence, the key question now is how to cross that inflexion point at the industry level or put simply, how do downstream players survive in the next 24 months and prepare for the market rebound?

One of the answers is market consolidation, which will lead to a stronger value proposition/optimised value chain overcoming all segment weaknesses and challenges exposed by the global health crises. The alternative, which is for all players to tread water, will likely lead to a weaker competitive position and lower value when the rebound ensues, adds Prasad.