McCaw joins the board of Astra as part of the merger, as does Michael Lehman, former chief financial officer of Sun Microsystems.

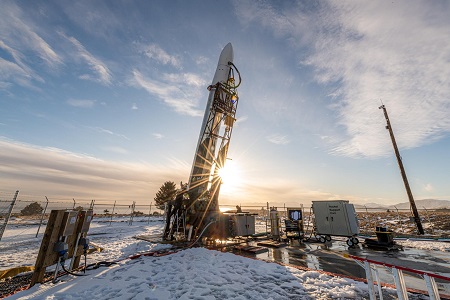

Astra is the first launch company to be publicly traded on the Nasdaq Global Select Market after its special purpose acquisition (SPAC) merger was approved.

Astra is the first launch company to be publicly traded on the Nasdaq Global Select Market after its special purpose acquisition (SPAC) merger was approved.

Astra raised approximately $500m in cash proceeds from the transaction to accelerate growth, expand its addressable market, and develop its space services platform. CEO Chris Kemp and Astras management team will continue to lead the combined company.

Shareholders of SPAC Holicity Inc. approved the merger, and Astra became a publicly-traded company on July 1 under the ticker ASTR.

Chris Kemp, Founder, Chairman and CEO of Astra, said: Becoming a public company is an important milestone in our mission to improve life on Earth from space. All of us at Astra are humbled by the opportunity to have the support of public shareholders and are grateful to the many people who have contributed so much to help us realise our vision of a healthier and more connected planet. We are pleased to welcome Michael and Craig to the Astra Board of Directors. They are seasoned leaders who bring immense collective experience in public technology company operations that will be beneficial to Astra and its shareholders.

Craig McCaw, Chairman and CEO of Holicity, added: “I am excited to support Chris and his talented team as Astra begins the next chapter as a public company.

As part of the business combination, McCaw, a pioneer of the telecommunications industry, and Michael Lehman, former CFO of Sun Microsystems, will join Astras board of directors.

Deutsche Bank Securities acted as lead financial advisor and capital markets advisor to Holicity. BofA Securities acted as lead placement agent on the PIPE, financial advisor, and capital markets advisor to Holicity. PJT Partners acted as sole financial advisor to Astra and as a placement agent on the PIPE. Ropes & Gray LLP acted as legal advisor to Astra. Winston & Strawn LLP acted as legal advisor to Holicity.