While pricing is beginning to stabilise, the mobility market is now seeing pricing erosion in the short term, due to the Covid-19 pandemic and its impact on global travel.

The average capacity pricing levels in video markets have dropped 30% in aggregate over the past five years, while data markets have experienced 60% declines, according to Euroconsult.

The average capacity pricing levels in video markets have dropped 30% in aggregate over the past five years, while data markets have experienced 60% declines, according to Euroconsult.

In its latest research titled, FSS Capacity Pricing Trends, Euroconsult reported the dramatic pricing declines of the past five years have slowed as a result of notable slowdowns in new capacity supply additions.

However, intense pricing pressure is expected to return in advance of new capacity coming online in the 2022-23 timeframe. While pricing is beginning to stabilise, the previously strong mobility market is now seeing pricing erosion in the short term, due to the Covid-19 pandemic and its impact on global travel.

We are seeing a mixed landscape in current pricing trends, said Brent Prokosh, Senior Affiliate Consultant at Euroconsult and author of the report. Despite the generalised pricing declines globally, strong demand for HTS capacity in places such as North America and Southeast Asia has led to regional shortages, alleviating pressure in the short-term. While fewer regions have reported sharply declining capacity pricing levels, more challenging competitive environments are reported for Latin America and the Russia & CIS regions. Further, at key orbital hotspots, Direct to Home (DTH) television platform pricing has also been notably resilient.

While DTH pricing of up to $8,000/MHz/month is still in effect in some locations, many platforms have sought to reduce their commitments through lower volume and/or shorter-term renewals. On the lower end, capacity pricing ranges have remained relatively stable over the past year, with $600/MHz/month for regular and less than $100/Mbps/month for large-volume long-term HTS capacity leases still prevailing.

In its third annual edition of the report on satellite capacity pricing trends, Euroconsult provides an analysis of the structural trends impacting the industry and delves into regional pricing for nine different parts of the world. The analysis is based on an expansive database of more than 2,000 capacity pricing contracts and includes roughly 100 new price points derived from more than a dozen interviews and continuous desk research conducted over the past 12 months.

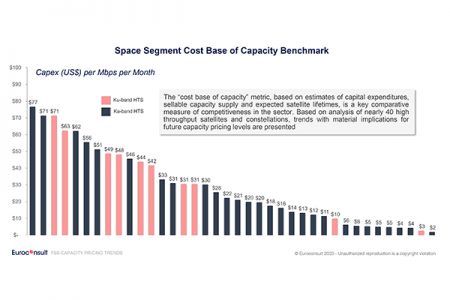

It includes capacity supply fill rates and case studies on the cost base of satellite capacity. It also breaks out pricing trends by spectrum and type of service and includes an overview of Milsatcom and mobility pricing. Additionally, for the first time, this years edition of FSS Capacity Pricing Trends includes a section on in-orbit life extension services. It also provides an analysis of the cost base of capacity for nearly 40 HTS systems, including all major Very High Throughput Satellite (VHTS) systems and Non-Geostationary Orbit (NGSO) broadband constellations.

The research projects that HTS fill rates, which are comparatively lower than regular capacity, are expected to drop from 50% as of 2020, to below 20% by 2023 with new capacity expected to come on line in that time frame. This oversupply will put further pressure on capacity pricing. As a result, Euroconsult projects that operators will seek to drive utilisation of new capacity by testing the price elasticity of demand.

Another way that operators are responding to oversupply and pricing erosion is by adopting vertical integration strategies, said Prokosh. This has the potential to provide them with a higher degree of control over pricing conditions. It is an especially relevant trend, given expectations that competition will continue driving the benefits of the lower cost base of capacity towards end-user services as opposed to the tradition FSS operator wholesale lease model.