Data traffic over satellite networks is expected to grow 7.8% compound annually by 2031.

The ground station segment is to remain quite stable over the 2022 2031 period, with a year-on-year growth of 1.4% and a forecasted market value of $3.6bn by 2031, driven by the growing demand for data & services, according to the latest Ground Segment Market report by Euroconsult.

The ground station segment is to remain quite stable over the 2022 2031 period, with a year-on-year growth of 1.4% and a forecasted market value of $3.6bn by 2031, driven by the growing demand for data & services, according to the latest Ground Segment Market report by Euroconsult.

However, this stability hides the transformation towards very high throughput connectivity and non-geostationary (NGSO) constellations at the Satcom level. Despite delays, NGSO constellation deployment is already counting for most of the growth at this level, with terrestrial competition for video services playing a major role in stunting the growth of the satellite broadcast market value. The terrestrial competition for video services is also playing a major role in the decline of the satellite broadcast market value, despite a temporary and limited growth due to the c reallocation process in the US.

From changes in the demand of both Satcom and Earth Observation domains, to ground station and user terminal technological evolution caused by NGSO constellations deployment, the ground segment ecosystem is sustaining significant transformation.

The commercial user terminal segment is also expected to experience a major surge in market value due to the sustained effort to build up NGSO constellations, alongside the overall growth in data traffic over satellite networks, with an expected 7.8% compound annual growth up to 2031. This in turn will contribute to the acceleration of flat panel antenna (FPA) development, especially the electronically steered variants, as they are better suited to track multiple satellites. Electronically steered antennas (ESAs) are thus expected to reach more than half of the sold commercial user terminals by 2031.

The defence segment is also seeing a demand around the development of new-generation systems, including core ground stations and user terminals. Several European countries have already signed ground segment contracts ahead of new satellite deployments, while the USA’s defence sector is still experiencing significant demand for the sustainment of existing terminals. Instead, the USs greater opportunity is expected to come from the renewal and augmentation of approximately 17,000 terminals currently in use by the different military forces.

The deployment of software-definition in both satellite systems and within ground infrastructure will also stand as a key item in the product roadmap of many ground segment suppliers, with a need to partly transition from a role of hardware to technology suppliers. Satellite operators are relying more and more on virtualization in place of physical hardware, reducing expenditures and improving ground segment flexibility.

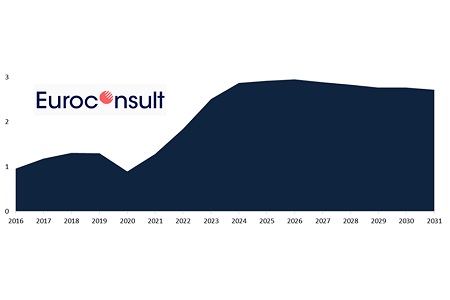

Ground Segment as a Service (GSaaS) providers – especially in EO – are deploying global networks to offer services to satellite operators, shifting the cost from capital expenditure (CAPEX) to operating expenses (OPEX), bolstered by the proliferation of small satellite constellations. The GSaaS market value has so far grown proportionally with the pace of deployment of small satellites on a trend to peak at $250m by 2026. But the window for market expansion is limited as the market will deflate as it matures to $200m by the end of the decade.

The ground segment industry is also not immune to the near-term challenges of supply chain issues and the cost inflation of raw materials and components.

Euroconsults newly released annual Ground Segment Market Prospects report provides a strategic overview of all ground-based elements for key downstream services, with in-depth analyses and forecasts to capture the dynamics of the ground segment industry. The report also assesses global ground station trends and user terminals for Satcom and Earth Observation – for both Civilian and Defense actors as well as examining key players in the industry. Visit Euroconsults Digital Platform to find out more.