Claudia Vaccarone, Head of Market Research and Customer Experience at Eutelsat explains how market trends for HD viewership are changing in the MENA

The Eutelsat TV Observatory, is a consumer research tool through which Eutelsat monitors TV reception trends in 51 countries. Originally covering Eutelsat?s Hotbird satellites, the research has progressively expanded and since 2010 has also taken in the MENA region.

The Eutelsat TV Observatory, is a consumer research tool through which Eutelsat monitors TV reception trends in 51 countries. Originally covering Eutelsat?s Hotbird satellites, the research has progressively expanded and since 2010 has also taken in the MENA region.

?This research is designed to measure the reach of our satellites to gain valuable insight into TV trends in different countries, as well as to understand how TV signals reach consumer homes,? says Claudia Vaccarone, Head of Market Research and Customer Experience, Eutelsat.

Eutelsat collected data of TV reception modes and resolution of channels watched in households across the 14 Arab speaking markets that it monitors, namely, Morocco, Algeria, Saudi Arabia, Egypt, Tunisia, UAE, Libya, Lebanon, Jordan, Iraq, Yemen, Oman, Kuwait and Syria.

The footprint of 7/8-degrees West goes beyond that, as it also reaches into Sudan, Eritrea and other markets where it is more challenging to gather consumer insights. However, these 14 markets are core for the Arab speaking population. For 2017, Eutelsat updated its study in Morocco, Algeria, Egypt and Saudi Arabia that together represent 70% of TV homes in the region. While the UAE market is extremely dynamic, it was covered by Eutelsat in its 2016 survey so didn?t require a new wave of research.

?We have seen significant demographic growth in the four countries surveyed this year which has been particularly valuable for assessing the engagement of younger audiences with TV viewing

?The MENA market is growing, from 64.3m homes to 66.2m homes in a year. Within that overall context the average percentage of TV set ownership has gone up by 1% to 95% in 12 months. In the UAE and Saudi Arabia, this number is virtually 100%, while it varies in other markets. The number of TV homes has consequently gone up, by 4%to 62.6m homes,? adds Vaccarone.

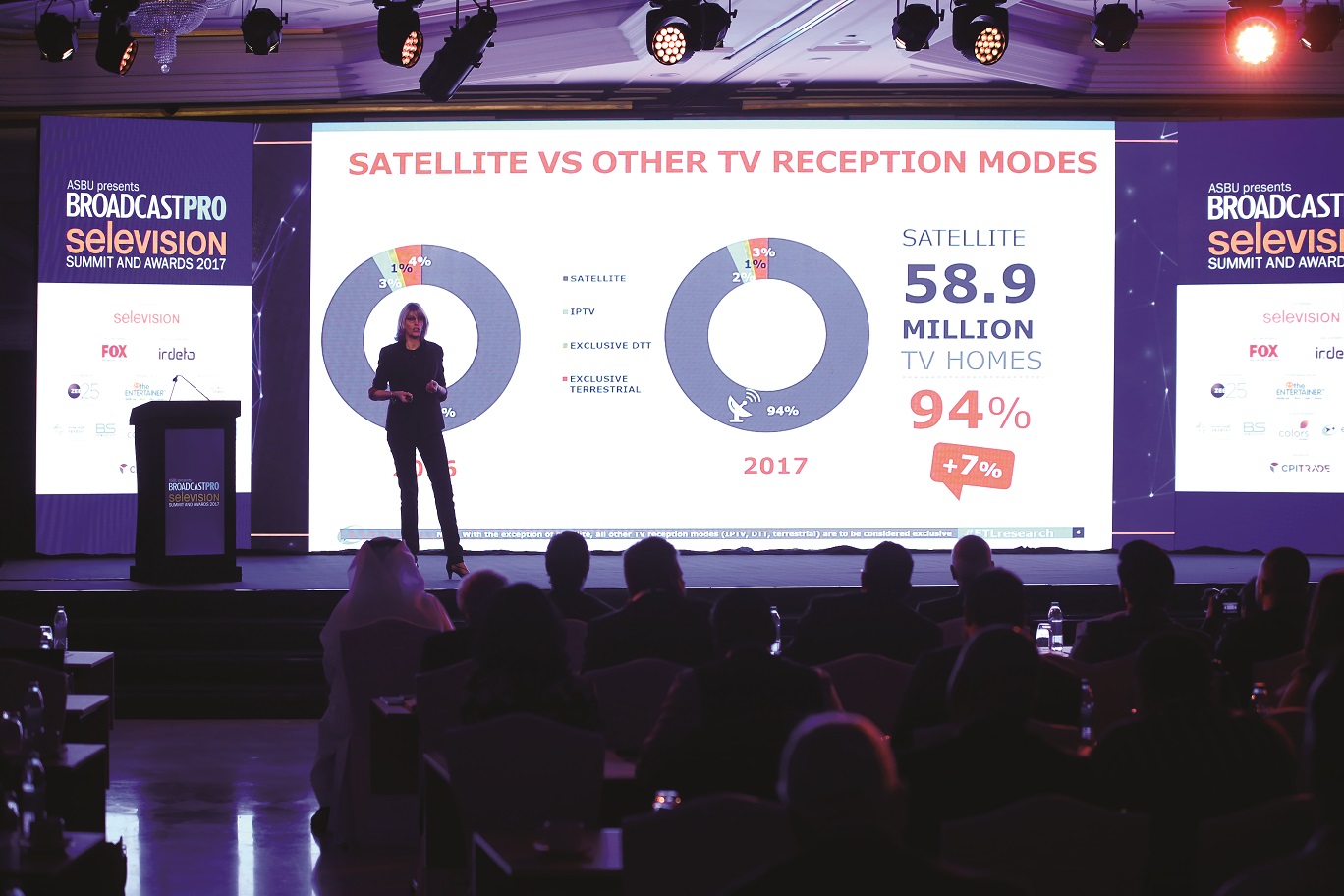

Another finding, which comes as no surprise, is that satellite reception is still the leader in helping channels reach viewers. It remains the main digital TV platform chosen by consumers and Vaccarone says it has conquered 100% of the growth in TV homes. All of the new 1.8m TV homes in the region are now equipped to receive TV via satellite, and this includes TV homes that previously received only terrestrial television, be it analogue terrestrial or DTT. The overall share of IPTV homes saw a dip of 1% compared to last year due to the growth of satellite TV in some of the largest countries covered by the survey. There are about 1.5 million TV homes equipped with IPTV in 14 Arab-speaking countries, with the UAE being the biggest market with 1 million TV homes. The rest are mainly in Saudi Arabia, with a few thousand homes in Morocco and Egypt.

?There are 58.9m TV homes reached by satellite, which accounts for 94% penetration and an overall growth of 7% in one year. The majority of these homes are served by 7/8-degrees West according to Vaccarone, where 56.2m TV homes prefer the Eutelsat/Nilesat orbital position. This is a growth of 3.1m homes in one year.

?The line-up on the 7/8-degrees West neighbourhood has continuously expanded over the years, now reaching 1,208 channels, of which 1,049 are FTA and 159 are pay-TV, in the premium OSN and beIN platforms. 55% of channels are exclusive to 7/8- degrees West,? says Vaccarone.

It is also clearly evident that there is a surge in HDTV equipment uptake, which is not surprising as the region?s audio-visual landscape is maturing rapidly with high consumer equipment renewal rates.

?Last year, 30% of the homes in the region adopted HDTV equipment, to reach 17.7m homes. This year 46% of homes are HD-equipped, which translates to 28.2m homes. This reflects 59% growth, showing the significant momentum for HDTV. This is also complemented by the surge of HD channels now available in the region, most of them available free to air? explains Vaccarone.

?This is similar to what was happening a few years ago in more mature markets. There is a natural cycle of every six to seven years when consumers renew their TV sets across all the markets we survey.?

Vaccarone says the installed base of homes connected to 7/8-degrees West has a higher incidence of HD equipment, reflecting an offer of 179 HD channels of which 102 are free-to-air. Today, there is a total of 306 HD channels in the region, of which 58% are exclusive to 7/8 degrees West.

?We see a dual trend in HD: on one side both commercial and public service channels are transitioning from SD to HD, for example Alaraby TV, Quran TV and public service SNRT. On the other side, new channels are coming on-board directly in HD format, like beIN Sports Global and Sama Dubai,? says Vaccarone.

Vaccarone concludes that the positive cycle measured by Eutelsat?s survey reflects higher HD awareness and more competitively priced consumer equipment as well as increased availability of compelling HD content. These are the forces accelerating adoption and change.