Research spanning FSS and HTS satellites in multiple frequency bands and regions shows broadening price disparity and how prices will stabilise with hiatus in in-orbit capacity growing.

In 2020, we can expect to see that the growth of satellite capacity on orbit will slow down, and pricing levels per megahertz (MHz) for regular capacity and per megabits per second (Mbps) for HTS capacity will have both stabilised at lower rates of decline. This trend is projected to continue through 2020, according to new research from Euroconsult titled FSS Capacity Pricing Trends. The analyst details pricing for traditional C-band, Ku-band and High Throughput Satellite (HTS) capacity broken out by contracts, regions, spectrum bands, and applications in the report.

In 2020, we can expect to see that the growth of satellite capacity on orbit will slow down, and pricing levels per megahertz (MHz) for regular capacity and per megabits per second (Mbps) for HTS capacity will have both stabilised at lower rates of decline. This trend is projected to continue through 2020, according to new research from Euroconsult titled FSS Capacity Pricing Trends. The analyst details pricing for traditional C-band, Ku-band and High Throughput Satellite (HTS) capacity broken out by contracts, regions, spectrum bands, and applications in the report.

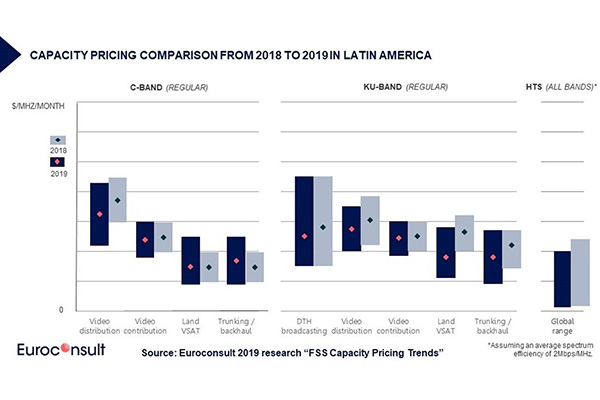

Based on hundreds of data points spanning nearly all segments, frequency bands, and regions, the report uncovered broadening price disparity. It cites capacity pricing as low as $800 per MHz per month for data applications in regions such as Sub-Saharan Africa, Russia, and Central Asia, and notes market resilience with pricing remaining as high as $8,000 per MHz per month in important orbital hot spots for video broadcasting. While the cost per Mbps for HTS capacity has trended lower in the past 12 months, demand for high-quality HTS capacity in certain bands and regions has exceeded supply, enabling stable pricing in those markets.

The slowdown in supply growth has helped the market regain a certain degree of equilibrium with demand growth also contributing to the stabilisation of pricing conditions underway today, commented Brent Prokosh, Senior Affiliate Consultant at Euroconsult. Pricing ranges remain highly dispersed, although convergence in pricing levels for regular Fixed Satellite Services (FSS) capacity and HTS bandwidth for data applications has been observed.

Euroconsult notes that the double-digit pricing declines that were observed in the years prior to 2018 are now rare and limited to several localized markets. However, the research firm projects that todays pricing stabilisation is likely to be short-lived for data-oriented applications as a massive volume of attractively priced supply from Very High Throughput Satellites (VHTS) and Non-Geostationary-Satellite Orbit (NGSO) constellations currently under construction, is expected to enter service in 2021.

The research includes an analysis of how pricing parameters have evolved over the past 12 to 18 months and documents average and specific pricing data points. It includes a table with detail on more than ten actual satellite capacity lease contracts in the 2018 to 2019 time period and provides analysis of the factors impacting capacity pricing. The report also reviews the evolving cost of building and launching FSS, HTS and NGSO satellites.

The most frequent questions that our analysts are asked relate to the cost of capacity, remarked Pacome Révillon, Chief Executive Officer of Euroconsult. Rather than just providing anecdotal evidence, we embarked on this in-depth research to delve into the details and more fully understand the changing dynamics of satellite capacity pricing. The report addresses the satellite bandwidth market with the perspective and authority that the industry has come to expect from Euroconsult.