DAZN will account for one third of streaming spend on sports in 2025 following its $1bn deal for the 2025 FIFA Club World Cup.

Streaming services are set to contribute a significant portion of global sports rights spending in 2025, with their combined investment reaching $12.5bn, according to Ampere’s latest sports media rights data. This figure represents 20% of the total $64bn spent on sports rights worldwide, with much of the growth driven by general entertainment streamers expanding their sports offerings. Despite this shift, sports-focused streaming service DAZN will remain the world’s top spender on sports rights.

DAZN is expected to account for one-third of streaming expenditure on sports in 2025, largely due to its $1bn deal for the FIFA Club World Cup. The platform has increased its investment in premium sports rights across key European markets, including Germany, Italy, Spain and most recently, France. Its share of the global sports rights market is set to rise even further once its acquisition of Australia’s Foxtel is finalized.

As subscription growth in mature markets slows, general entertainment streamers are leaning into sports to attract and retain audiences. Amazon ranks as the second-largest streaming investor in sports, with its market share climbing from 18% to 23% after securing NBA broadcasting rights from the 2025-26 season. The company also holds key sports rights, including NFL Thursday Night Football in the US and the UEFA Champions League in Germany, Italy and the UK.

YouTube TV remains the third-largest sports rights spender among streaming services, thanks to its multi-billion-dollar deal for the NFL Sunday Ticket. Meanwhile, Netflix has climbed to fourth place in sports rights spending, fueled by its three-year contract for exclusive NFL Christmas Day games and its $500 million annual partnership with WWE, which began in 2025.

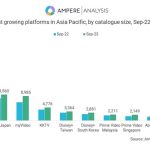

Live sports have proven to be a powerful tool for subscriber growth and retention, particularly with the introduction of ad-supported streaming tiers. Ampere’s SVoD Economics data highlights the impact of live sports on platform subscriptions.

Netflix gained 1.5m US subscribers after the Paul/Tyson boxing match, with 80% remaining active a month later.

Nearly 700,000 users subscribed to Netflix for its NFL Christmas Day games.

Peacock added 2m new subscribers over the weekend of its exclusive NFL playoff game in 2024.

Paramount+ saw a surge of 2.4msign-ups on the day of its Super Bowl coverage in 2024.