Streaming services in Asia Pacific continue to extend their catalogues to bolster market positioning.

Economic challenges and market saturation in mature regions have led to the slowest growth in streaming since the onset of the pandemic in 2020, according to research from Ampere Analysis.

Despite this, the Asia Pacific region has showcased remarkable resilience, driven by diverse and rapidly expanding economies that support enhanced connectivity and increased disposable income, fueling streaming growth.

Ampere Analysis’s research, to be presented this week at the Asia TV Forum, anticipates that by the close of 2023, over 40% of the world’s streaming subscribers will be concentrated in Asia. Streaming services in the region are actively expanding their content offerings to fortify their market positions.

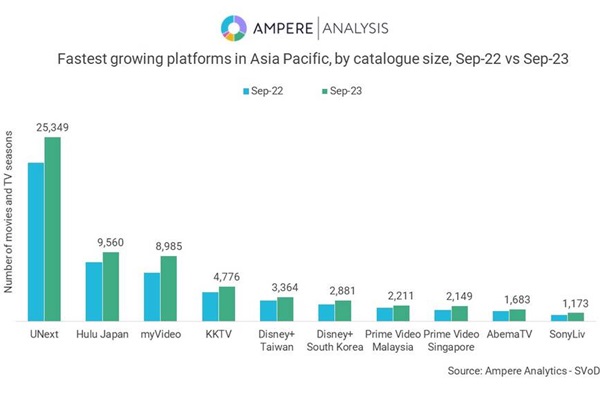

Ampere closely monitors content strategies across 30 local and regional platforms in the Asia Pacific region, varying in size and focus. Notable local players, including UNext and Hulu in Japan, HamiVideo in Taiwan, and South Korea’s WatchaPlay, boast catalogue sizes comparable to global giants Netflix and Prime Video.

Catalogue expansion remains a key driver of the streaming market’s rapid growth in the region. Major local platforms in Japan, such as UNext and Hulu Japan, have significantly grown their catalogues by approximately 17% compared to the previous year. Taiwanese platforms like MyVideo and KKTV have also enriched their content offerings, with MyVideo offering 9,000 titles and KKTV providing 4,800 titles to viewers by September 2023.

While Indian platforms have experienced slightly less growth in their catalogues, local services like Disney+ Hotstar and Eros Now dominate the market. However, Disney+ Hotstar faced a setback with the recent loss of IPL distribution rights, impacting its subscriber base.

The diverse Asian market poses unique challenges, with no one-size-fits-all strategy for success. Younger viewers in Asia, particularly those aged 18–24, exhibit a preference for less mainstream genres such as Anime and Horror. However, preferences vary within demographic groups, with Anime enjoying popularity in the Philippines and Japan but receiving lower scores in Australia and India.

Attitudes toward local and imported content also differ across the region. Consumers in China, India, Japan, and South Korea prefer locally-produced content, while those in the Philippines, Indonesia, Malaysia, and Thailand are more inclined to watch foreign-language content.

The importance of an effective subtitling and dubbing strategy is emphasised for streaming platforms in the region to cater to the demand for imported content. Indonesians show a strong preference for subtitles, whereas Thai consumers prefer dubbed shows and movies.

Commenting on the findings of the report, Tingting Li, Senior Analyst, Ampere Analysis, said: “As the Asia Pacific region continues to represent a solid growth opportunity, and as locally-produced content grows in popularity outside the region, both local and international streamers are primed to invest further in creating and acquiring content in the region. To win audiences in this crowded market it is important to match content to the preferences and viewing patterns of each country. Platforms should complement widely-enjoyed, mainstream content to attract broad audiences, with up-and-coming niche genres to attract younger viewers. The right mix of subtitled and dubbed content will ensure audiences stay engaged and spur future growth.”