According to the report, the global revenue will grow from around $75.83bn in 2022 to around $171.86bn in 2028.

Global SVOD services will reach 1.9bn subscribers in 2028, in a market worth $171.9bn according to Rethink Technology Research.

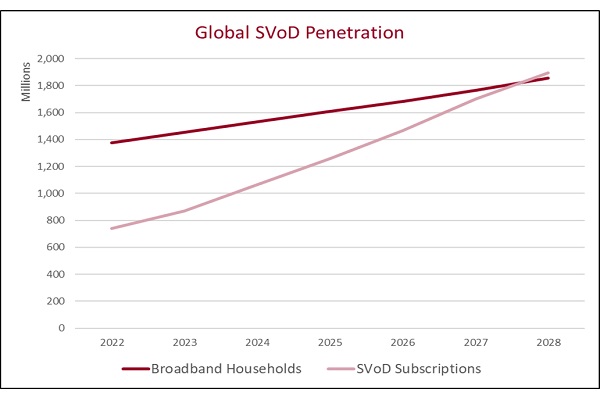

According to the report, global services’ subscriber counts grow from 738.9m in 2022 to 1.89bn in 2028 – passing the total count of broadband households. Meanwhile, global revenue grows from around $75.83bn in 2022 to around $171.86bn in 2028.

In its Subscription Video on Demand Market Forecast 2023-2028, the researcher examined the impact that the emergence of advertising tiers from the likes of Netflix and Disney+, as well as the increasing popularity of FAST channels will have on the traditional subscription video-on-demand market.

The analyst noted what it called a “wave of hysteria” in early 2022 after Netflix confirmed its first subscriber loss of 200,000 subscribers, or around 0.09% of its total. It added that in the year since, Netflix’s return to growth and confirmation of its advertising strategy has largely set the market at ease.

However, the current concern is the impact of these advertising tiers on SVOD growth, as well as the looming impact of FAST. These services are most often accessed through smart TVs from Samsung, Vizio, Roku, etc.

Rethink research noted: “Complicating counting is the fact that we are about to enter a phase where SVOD services have ad-supported customers, AVOD services have subscription tiers, and FAST will undoubtedly start playing with on-demand video. The clock is also ticking until these VOD services have live linear feeds, and Netflix is due shortly to launch its first live stream. Disney and Netflix are now in the early stages of their advertising expansion. Both have chosen to price their ad-supported bundles at a slight discount, to ensure that they can maintain their ARPU via the ads served. In time, we suspect that the SVOD platforms could see significant lifts in ARPU via advertising.”

That said, the report stressed that neither Netflix nor Disney have opted for an entirely free tier, supported by a much heavier advertising load. This is regarded as significant because the issue of account sharing has raised its head in the past year.

The analyst remarked that with free options, SVOD services would be able to migrate a user from an existing SVOD subscription and into a free account with only an email address and basic account details. While this would serve to keep the number of subscribers high, and potentially provide a significant boost if the estimates of ‘freeloader’ accounts are as high as some in the industry maintain, as soon as a payment method was required, the success of converting a freeloader into an active subscriber would plummet.

Rethink stated that Netflix will continue to boast about its profitability, especially when compared to competitors which are still operating at a loss, including Comcast, which just reported full-year revenues that showed $2.1bn earnings for Peacock, but was hamstrung by an attributed loss of some $2.5bn.

“To this end, ARPUs across the board need to rise, and advertising is going to play a major role in this regard,” it said.