More than 1bn hours of video are watched every day on YouTube globally, according to the report.

YouTube’s global advertising revenue is set to rise 4.0% in 2023 to reach $30.4bn, according to the latest report by WARC. This is more than double the rate of growth recorded in 2022, with ad revenues expected to recover in the second half of this year.

The Alphabet-owned video platform is actively looking for ways to forge deeper connections with viewers, creators and brands through multi-format video strategies.

WARC Media forecasts YouTube’s revenue growth to accelerate by 10.3% in 2024, to reach $33.5bn by the end of the year.

The worldwide slowdown in digital ad investment has had an impact across the industry. It reaches half of all internet users globally (2.07bn), and commands a strong position in the online video advertising market. However, YouTube remains popular among consumers. Q4 2022 ad revenue declined 8.8% year-on-year, as marketers shifted investment to retail media and search and it battled against TikTok, Instagram Reels and Apple’s ATT.

YouTube is prioritising Shorts and Connected TV engagement and is innovating with unskippable 30s ads and “pause experiences” on TV to help marketers engage audiences across screens and achieve both performance and brand-building goals.

Alex Brownsell, Head of Content, WARC Media, said: “It’s been a tricky 12-month period for YouTube, which is increasingly battling on two fronts, against short-form video platforms like TikTok as well as long-form content streamers in the connected TV space. However, as trading conditions improve in digital advertising, YouTube can expect to see revenue growth improve.

“In this WARC Media’s Platform Insights report, we take a closer look at YouTube to provide marketers with evidence-based insights on the challenges and opportunities the platform offers at a time when ad formats and technologies are fast evolving and understanding audiences is becoming ever more important.”

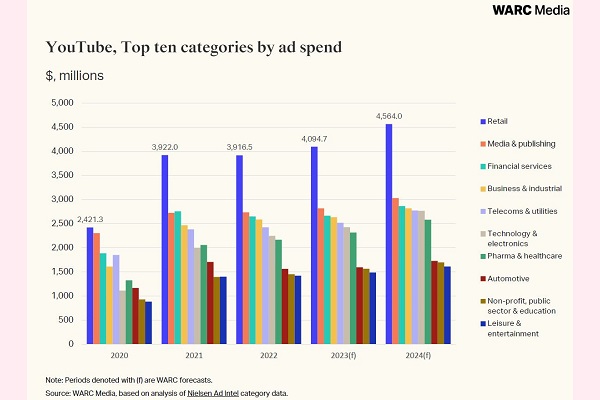

Retailers are expected to spend $4.1bn on YouTube ads this year, a 4.6% rise on 2022, according to WARC Media data.

Yet growth from other sectors has been harder to achieve. WARC Media data forecasts an increase this year in technology and electronics (+8.0%) and toiletries and cosmetics (+4.3%).

A WARC survey of marketers in Asia Pacific found that YouTube is the most popular platform for digital display. Nearly half (49%) of brands in the region run display ads on YouTube. However, it appears less appealing to APAC marketers (17%) from a shoppable advertising perspective.

YouTube is the world’s most popular online platform and more than 1bn hours of video are watched every day on YouTube, per Alphabet data. Its adult advertising reach is estimated to be 2.07bn, almost twice as much as TikTok and Instagram respectively, according to Kepios.

As the platform looks to improve user engagement and make it more shippable, YouTube Shorts (videos lasting 60 seconds or less) will provide more opportunities for marketers to reach new audiences.

However, Shorts’ 50bn daily viewer total is some way behind the 140bn daily views achieved by Instagram Reels, while under 18s spend on average 60% longer on TikTok than with YouTube content.

Overtaking Netflix in 2022, according to Nielsen, YouTube is the most popular ad-supported streaming service in the US, accounting for 22.9% of OTT viewing in March 2023.

APAC is a key growth region for YouTube – from live shopping and Shorts to gaming. The region’s high mobile penetration, advanced e-commerce, and influencer culture have helped to shape YouTube’s global strategy.