Video consumption in the Middle East and North Africa (MENA) has increased in recent times as a result of content availability on alternative media besides television. With the availability of localised online content and targeted on-demand services for the diaspora on the rise, traditional broadcasters and service operators are exploring new avenues and services to […]

Video consumption in the Middle East and North Africa (MENA) has increased in recent times as a result of content availability on alternative media besides television. With the availability of localised online content and targeted on-demand services for the diaspora on the rise, traditional broadcasters and service operators are exploring new avenues and services to retain the fickle modern viewer.

Frost & Sullivan, the knowledge partner for CABSAT 2015, will present an exclusive white paper on the Trends in Broadcast and New Media Video in Middle East and North Africa. This white paper is an industry outlook covering key findings on market penetration, type of content, leading companies in the region, drivers and restraints, technology and market trends, business models and some case studies.

The region offers rich potential with a few countries ranking among the highest digital television and high-speed internet penetration in the world, said Vidya S. Nath, Research Director, Digital Media, Frost & Sullivan.

While discussions about piracy abound and media companies are worried on how to stem it, they need to drive all their energies towards making a diverse portfolio of content and services available that can appeal to viewers in the region.

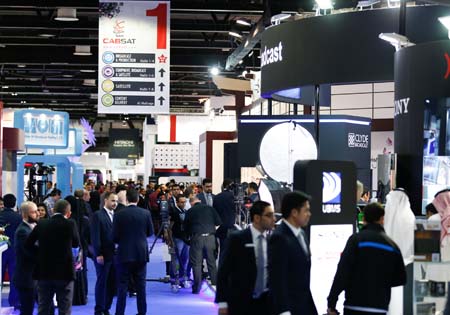

Andrew Pert, Show Director of CABSAT, added: As the leading platform for the broadcast, production, content delivery, digital media and satellite sectors across the Middle East, Africa and South Asia (MEASA), CABSAT is at the forefront of delivering dialogue between global media and entertainment organisations and their local counterparts on how best to drive innovation into their businesses and content offerings. With regional consumers video content consumption among the worlds highest per capita, the convergence of international broadcast, film, production, internet, telecom and consumer electronics sectors has resulted in strategic investment inroads and monetisation avenues being rife across the MENA market CABSAT is the gateway to capitalising on regional opportunities.

Frost & Sullivan finds that satellite television will continue to dominate the regions linear television services over the next three years. High Definition (HD) TV channels will continue to grow swiftly by at least over 25% over the next three years, while content companies will likely start offering 4K video content over IPTV soon. With the region waiting for HEVC-compliant set-top boxes to increase support of next generation television services, international mega events including the FIFA World Cup in 2022 in Qatar will boost the penetration of Ultra High Definition Smart TVs to about 50% of households in 2020.

Correspondingly, there is an active growth in viewership trends for video over alternative platforms, social media and mobile networks with Frost & Sullivan urging all broadcasters and service providers to prioritise the segment now. The proliferation of localised content across all genres for different diaspora – especially news and current affairs – continues on various portals, while all leading regional public and private broadcasters have launched dedicated social media presences through platforms such as Facebook, Twitter, YouTube and Linkedin to capture a younger demographic of viewers. For the next three years, there needs to be a focus on personalised viewing, acceleration of multiscreen services and multimedia advertising. Content producers and aggregators seek innovative solutions for compression, ad-insertion, video-on-demand, media asset management, and digital rights management that can help them centralise their multimedia operations and unify it with their linear television workflows.

Many media networks and content companies struggle with the regions bipolar and fragmented trends, across the region. While most of the GCC countries are highly mature in new media consumption, the rest of the region continues to experience fractured network speeds and stringent regulatory frameworks. Constant innovation in packaging content and advertising will help in achieving heightened video penetration.